A tax credit can help out in the most troubled times. For example, the American Opportunity Tax Credit, or AOTC, applies to a big part of American students – and some of them can even qualify for an overwhelming tax refund!

Tax Credit For Students

It’s no secret that being a student costs a huge amount of money. First, it’s a student loan. Then, other educational activities and purchases: a laptop or a computer, textbooks, and so on. The most recent academic year of 2021-2022 averaged tuition and fees of $10,740 for public schools, as well as $38,070 for private schools. That’s 1.6% and 2.1%, respectively, higher for full-time undergraduate students than the year before! Sadly, saving plans in colleges and the student loan interest deduction doesn’t cover all the bigger expenses. That’s when American Opportunity Tax Credit (AOTC) comes in. In 2015, the Protecting Americans from Tax Hikes (PATH) Act made AOTC permanent, letting many students and their parents or caregivers let out a sigh of relief.

The AOTC is much better than the Hope Credit, only expanding its powers and letting more lower-income households receive a college education. So, who’s eligible for the AOTC? As the IRS website states, the student must be “pursuing a degree or other recognized education credential.” In addition, they should be enrolled in college at least half-time for a minimum of one academic period at the beginning of the tax year. At that same point in time, they shouldn’t have yet finished four years of higher education. Students can’t claim AOTC if they’ve already received it or Hope credit for more than four tax years. Finally, eligible applicants must not have a “felony drug conviction at the end of the tax year,” IRS concludes.

Qualified Expenses And How To Apply

When speaking of the financial relief regarding education, there’s an enormous list of purchases to cover. What does qualify for AOTC, then? The tax credit includes any amount of tuition after other contributions have already been applied. These tax-free bonuses include scholarships, fellowships, Pell grants, veterans assistance, and employer assistance. Furthermore, purchases that are required for college enrollment will be covered by credit, such as any books, supplies, and other educational materials. It doesn’t matter if students buy them from schools or not, they qualify for AOTC. Any educational activities that are a part of the college program like sports, games, hobbies, and courses will be taken care of as well. On the other hand, the tax credit doesn’t involve insurance, medical expenses, accommodation and transportation payments, child care, and other living family expenses.

Want to claim AOTC? The responsible taxpayer or the dependent should have a Form 1098-T and Tuition Statement from the college they plan to or study in. Both domestic and foreign educational institutions can be eligible. Most of the time, schools and colleges present their students with a Form 1098-TPDF Tuition Statement by January 31. In case you’re curious about your credit, this form will help out – box 1 will show the amount received in that year.

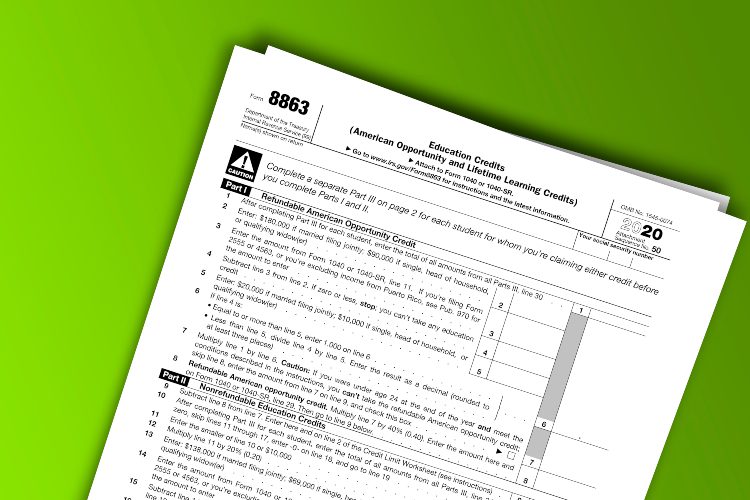

To claim the credit, complete Form 8863PDF and send it over with the tax return.

Sources: CNBC, IRS, TaxOutreach