As you likely already know, building a great credit score can take a lot of work. WalletHub claims it can help not only monitor your credit score, but also build it. Let’s take a look at their claims…

What Is WalletHub?

Previously called CardHub, WalletHub started in 2013 as a website focused on comparing credit cards. Over the years, the site started adding on tools that allowed users to also track their credit score. Now, WalletHub has an app and claims it can help users build their credit score. However, let’s start at the beginning: can you even trust the credit score the WalletHub provides?

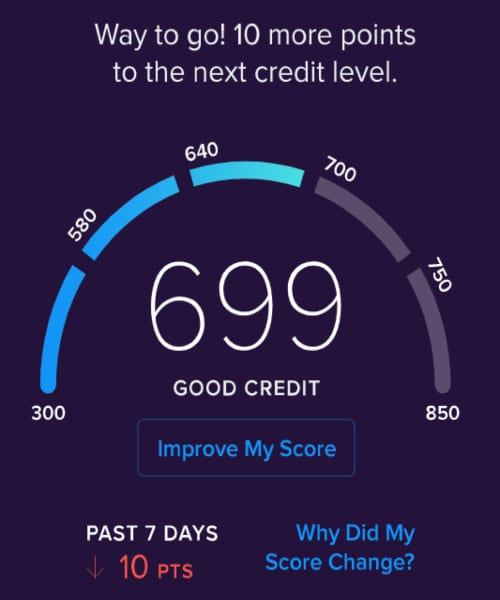

Well, WalletHub uses TransUnion’s credit score model, titled VantageScore 3.0, that gives users an average score based on their Experian, Equifax, and TransUnion numbers. To be clear: this is not the same as a FICO score, which most banks and institutions will look at when you apply for a loan. Still, for the vast majority of purchases, the score presented in the WalletHub will give you a pretty good idea of where you stand. Now, onto WalletHub’s credit score building features…

Daily Updates: Necessary?

One of the ways WalletHub claims it will help you build your credit score is by providing daily updates. In fact, the company proudly proclaims itself as the first credit monitoring service to provide regular updates. However, unfortunately, while true, this will likely make no difference to your credit score. These are soft pulls, so the peeks will not hurt your credit score, but are also unlikely to provide you with any data that weekly or monthly updates do not.

Meanwhile, the option to have a text notification if your credit score moves a certain amount of points one way or the other, is a handy tool that can keep you from a serious shock the next time you check your credit score.

Head To Credit Score School

Thankfully, while daily updates are not enough to separate the app from others, like CreditKarma, the company’s desire to educate its users does. Inside the app, there are tons of fantastic videos, Q&As, and tutorials that will help a user know exactly what they need to do to find themselves in a better financial position. In fact, there’s even a WalletLiteracy Score that lets a user know precisely how financially literate they are!

And, WalletHub doesn’t just encourage learning; it also encourages participation. Users that contribute thoughtful answers to questions are designated as “experts.” The free education section was developed alongside college professors from different universities around the United States. WalletHub says it wants to help people around the US prepare for all the significant financial challenges in their lives, from saving for a vacation to buying a new house.

All in all, while it might not be perfect, WalletHub is a great way to manage your credit score for free. Still, if you meet any difficulties with raising the credit score or getting a loan, make sure to contact a real financial advisor.

Sources: Dyer News, Merchant Maverick.